By entering this website, you agree that you're of legal age in your state to purchase electronic cigarette products.

VaporFi Online Vape Shop

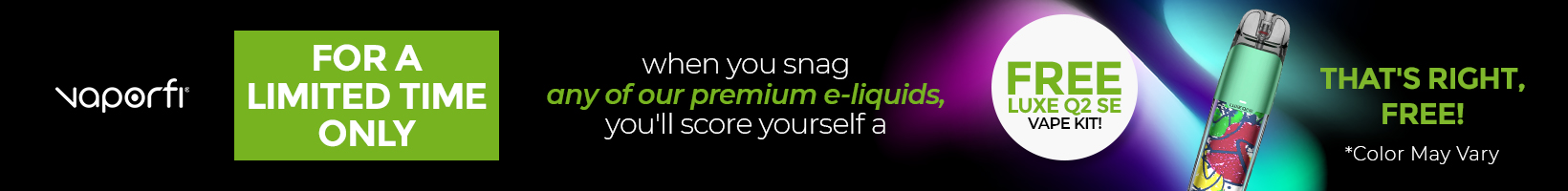

Dive into the vibrant universe of VaporFi’s online vape shop! Discover an unmatched selection of top-tier vapes, rich-flavored e-liquids, innovative mods, and much more. Our online vape store has something for every vaping enthusiast. Experience remarkable deals with our tempting offers, and enjoy free shipping on orders over $75 today! Adventure deeper into the community and buy vapes online with VaporFi.

Featured Flavors

Discover all of the best vape juice flavors that offer thrilling experiences for the vaping community. We host a variety of flavors on our online vape store from clean menthol and old-fashioned tobacco to fruity flavors like strawberry and other sweet tooth selections like chocolate.

Featured Vape Devices

Explore the best vapes our online store has to offer. Our signature brand Mig Vapor offers a diverse set of reusable vapes and flavored cartridges that satisfy any customer. You can even find a favorite amongst our partner brands which offer even more variety!

Buy The Best Vapes Online

VaporFi is the online vape shop of choice for countless customers and we’re on a mission to change the way you smoke. We cater to vapers of all levels of expertise, from the beginners looking for their first kit to the advanced cloud chasers looking for high-powered mods and the most complex of flavors. Our vape shop has an e-liquid or mod to fit every customer's need. We are constantly bringing you the most innovative technology in the world of vaping. You'll never be bored with the vapes and other products offered at VaporFi. We are committed to high standards, amazing customer service, and elevating your experience with our products.